Turkey Has Made the Final Decision on the Anti-dumping Case Against Fabrics/textiles From China

Turkey's final decision on the anti dumping case against China's fabrics / Textiles

On October 20, the Ministry of economic affairs of Turkey issued the final ruling on the anti-dumping case against China's quilted fabrics, and decided to impose an anti-dumping duty on Chinese export enterprises for a period of five years, with the tax rate of 17.29%. The Turkish customs tariff number of the product involved was 5811.00.

On April 11, 2010, Turkey's foreign trade department announced the final ruling on the anti-dumping case of curtain cloth and other textiles (Turkish customs tariff No.: 54075810.926005.316005.326005.336005.346006.316006.326006.346303.126303.92), and decided to levy an anti-dumping duty of 70.44% (up to US $5 / kg) on the above-mentioned products from the date of announcement. According to Turkey's statistics, in 2009, Turkey imported curtain cloth and other products from China with a total value of 98.87 million US dollars, accounting for 22% of the total imports of such products in that year.

Our company has rich experience in exporting this product to Turkey.

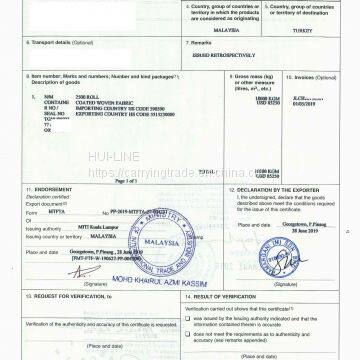

For the anti-dumping of fabrics to Turkey, our company can transit through Malaysia, and make Malaysia form MT FTA certificate of origin (form MT FTA is the certificate of origin of preferential tariff signed by Turkey and Malaysia) and relevant embassy documents (such as the signature of the exporter registration form), packing list and invoice, which can effectively avoid anti-dumping. To provide you with efficient and safe re export service

Re export operation process:

1. The goods are first sent from China to Malaysia (exporters only need to prepare normal export documents)

2. Our company will convert the cabinet in Malaysia and arrange the shipment to the destination country

3. Our company has customs clearance and cabinet change in Malaysia, and made form MT FTA and other documents in Malaysia

4. When the goods are exported from Malaysia to the destination country for re export, we should pay attention to the following: when the goods are produced, there should be no Chinese information, such as "made in China", "made in China", and no Chinese characters.

In order to save cost, our company uses the third country transit transportation to avoid the anti-dumping tariff. Our company has many years of third country re export operation experience and the third country re export team, to build a safe bridge for your transportation, please contact us for details

Tel: 13418470281 Allen (wechat synchronization) QQ:1265847535

FTA:

Send Inquiry to This Supplier

You May Also Like

-

For Solving the 25% Tariff of the United States on China's Product Operation, the Third Country to Avoid Its Anti-dumping Duty!!!NegotiableMOQ: 1000 Tons

-

In Order to Solve Argentina's Anti-dumping to China's Glass Mosaic, we Can Operate India's re Export to Avoid Its Anti-dumping Duty!!!NegotiableMOQ: 1000 Tons

-

In Order to Solve India's Anti-dumping to China's Stainless Steel Plate, we Can Operate Malaysia's re Export to Avoid Its Anti-dumping Duty!!!NegotiableMOQ: 100 Tons

-

Air - Sea and Air - Sea Intermodal Transit Trade Recommendations - for High Tariff Goods in TimeNegotiableMOQ: 100 Tons

-

Turkey Makes Final Anti Circumvention Ruling on China Related Polyester YarnNegotiableMOQ: 100 Tons

-

Detailed Description of re Export Trade Anti-dumpingNegotiableMOQ: 1000 Tons

-

The United States Made the Final Ruling of Anti-dumping Administrative Review on China's Composite Wood FlooringNegotiableMOQ: 100 Tons

-

In Order to Solve the High Tariff of the United States on China's Wood Flooring -- Malay re Export Avoidance!NegotiableMOQ: 100 Tons

-

U.S. Countervailing Preliminary Ruling on China's Quartz Countervailing ProductsNegotiableMOQ: 100 Tons

-

Eurasian Economic Union Makes Final Anti-dumping Ruling on Aluminum Strip Products Related to ChinaNegotiableMOQ: 100 Tons